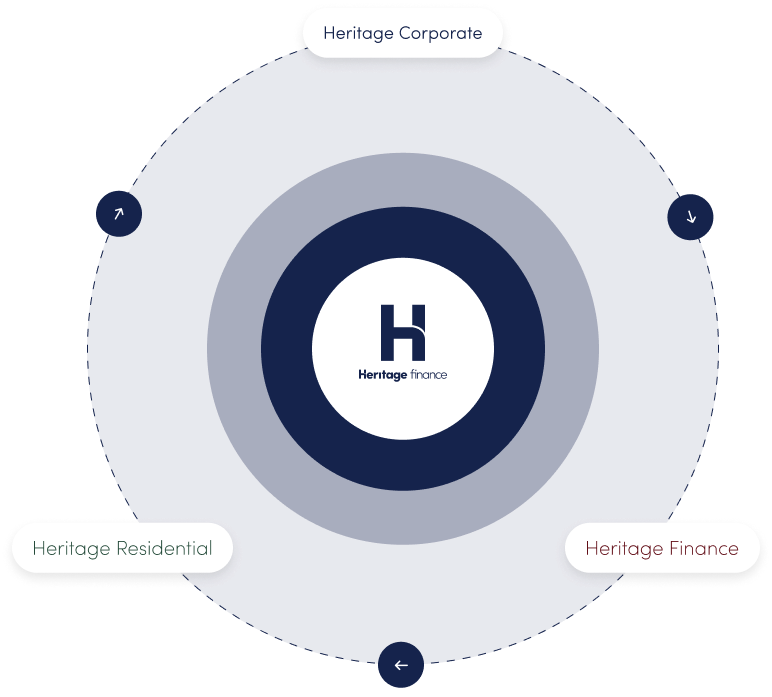

Whether you’re building a boutique townhouse project, subdividing land, or launching a multi-storey mixed-use development — the right funding structure is critical to success. At Heritage Finance, we provide tailored development finance solutions to help property developers access capital, manage risk, and maintain momentum throughout the project lifecycle.

We work with bank and non-bank lenders to source flexible funding options, even for projects that fall outside the box. From land acquisition to construction and residual stock, we’ll help structure the right facility to meet your goals and timeline.

We assist with development projects at all stages:

Choosing the right lender isn’t just about the interest rate. Consider:

Some lenders require a certain number of units to be pre-sold before releasing funds. We can help you find lenders with more flexible requirements — or even no presale options in certain cases.

Your experience as a developer can significantly impact lender appetite. If you’re a first-time developer or working with a new builder, we’ll help package your proposal in the best light.

Lenders will want to see a feasibility report, including projected sales, build costs, timelines, and contingency buffers. We can help you prepare a professional submission.

Some lenders will finance based on end value (GRV), others on cost. The right structure can make or break your project’s viability.

Speed matters in development. We can often assist with fast approvals through private lenders for time-sensitive land settlements or bridging solutions.

📌 We’re not just here to get you funding — we’re here to help you deliver your project successfully.

If you’re planning a new development or just starting your feasibility, we’d love to support you with clear advice and smart finance options tailored to your vision.

👉 Start a conversation with us today. Contact us and let’s discuss what’s possible.