Whether you’re looking to upgrade your work ute, invest in a fleet of vehicles, or find a tax-effective way to finance your next car, Heritage Finance offers tailored vehicle lending solutions to suit individuals and businesses alike.

We partner with both bank and non-bank lenders to offer a variety of structures — from traditional car loans to novated leases and commercial chattel mortgages — helping you secure the right vehicle on the right terms

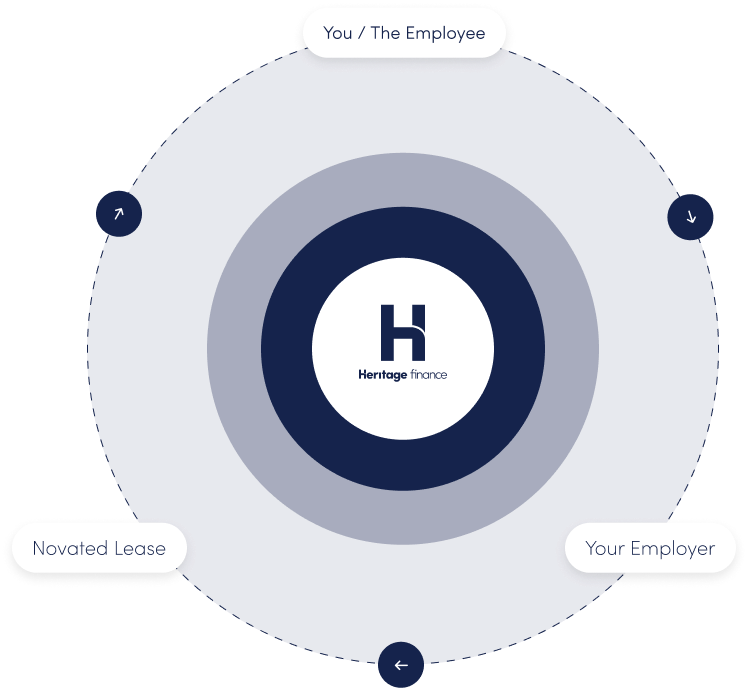

A Novated Lease is a three-way agreement between you, your employer, and a lender. It allows you to lease a car using pre-tax income, which can reduce your taxable salary and improve your take-home pay.

How it works:

● You choose the vehicle you want

● Your employer makes lease payments from your salary

● Running costs (fuel, insurance, servicing) can be bundled in

This option is often used by salaried employees looking for a tax-efficient way to drive a new vehicle, with flexibility at the end of the lease. The lease typically runs for 2–5 years and includes a residual (balloon) payment at the end.

When does it make sense?

● You want to lower your taxable income

● You’re employed full-time and have access to salary packaging

● You want one regular repayment that covers all vehicle costs

A balloon payment (also called a residual value) is a lump sum owed at the end of a car loan or lease. It lowers your regular repayments by deferring part of the principal until the end of the term.

Pros:

● Lower monthly repayments

● Greater cash flow flexibility

Considerations:

● You’ll need to pay, refinance, or trade in the vehicle when the balloon is due

● The car’s market value at that time may be higher or lower than the balloon amount

We help you plan for this in advance, so you’re not caught off guard — and we can assist with refinancing or upgrading options when the time comes.

Whether you’re buying your first car or upgrading your business fleet, we can help you drive forward with confidence

Speak with a vehicle finance expert today Contact us to explore your options and get started.