Self-Managed Super Funds (SMSFs) offer a powerful way to grow your retirement wealth — and yes, that can include residential property. But SMSF lending is highly regulated and structurally complex. It’s essential to get the right advice and lending structure from the outset.

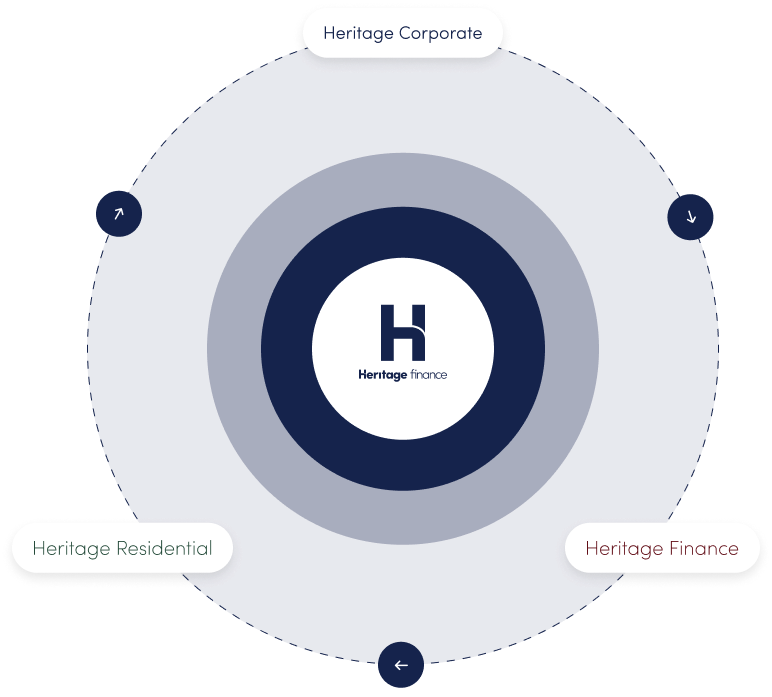

At Heritage Finance, we guide trustees through every stage of the SMSF lending process — from lender selection to loan structuring — ensuring your strategy remains compliant, tax-effective, and aligned with your retirement goals.

Whether you’re upgrading machinery, replacing aging assets, or expanding into new markets — we’re here to help you get the equipment you need without compromising cash flow.

You can use your SMSF to buy residential investment property — but there are strict rules:

Permitted:

Not Permitted:

SMSFs cannot buy a property to live in or use. The investment must meet the sole purpose test: growing retirement savings.

Most SMSF loans require a higher deposit (typically 20–30%), and lenders will closely assess your fund’s liquidity — that is, your ability to cover loan repayments, operating costs, and legal obligations without relying on external contributions.

You’ll need to demonstrate:

At Heritage Finance, we work with lenders who specialise in SMSF lending and understand how to evaluate super fund income — giving you more options and smoother approvals.

When borrowing through your SMSF, you’ll need to set up a Limited Recourse Borrowing Arrangement (LRBA). This is a legal structure that protects the fund’s other assets in case of loan default.

As part of this, the property must be held in a Bare Trust (also known as a Custodial Trust). Here’s how it works:

This structure ensures the lender’s recourse is limited to the property itself — not the entire fund.

Setting up the right structure is critical. We work alongside your accountant or financial adviser to ensure compliance from the start.

Help you plan for long-term property strategy within your fund

Whether you’re an experienced investor or just starting to explore your SMSF’s potential, we’re here to guide you through every step — from pre-approval to post-settlement.

Book a confidential SMSF lending consultation today.