Buying your first home is a big deal. Exciting, emotional, and often overwhelming. With changing property prices, government schemes, lender rules, and the challenge of saving a deposit — it can be hard to know where to start.

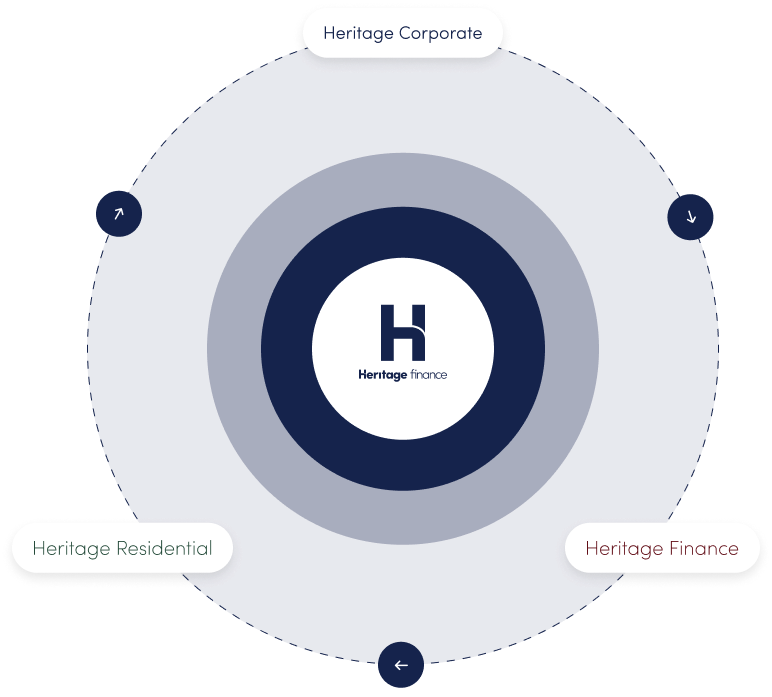

At Heritage Finance, we specialise in helping first home buyers understand their options and access the right support to get into the market sooner and with greater confidence.

There are a number of grants and government-backed schemes that could make a real difference to your buying power. Here’s a snapshot of what might be available to you:

A one-off payment (usually $10,000 or more) for eligible first-time buyers purchasing or building a brand new home. The amount and rules vary by state, but it can be a huge boost toward your deposit.

This allows you to buy with as little as 5% deposit – and the government guarantees the rest so you can avoid paying Lenders Mortgage Insurance (LMI). It’s available to both individuals and couples who meet income and property price thresholds.

Some states waive or discount stamp duty for first home buyers purchasing under a certain threshold. In NSW and VIC, there are also shared equity and rent-to-buy options available for eligible buyers.

Disclaimer: Eligibility and grant amounts vary between states. We’ll help you check what’s available in your specific location.

Lenders typically want to see that part of your deposit has been saved gradually over time — usually over a 3-month period. This is what they call genuine savings. It shows the bank that you’re financially disciplined and capable of managing loan repayments.

However, not all lenders treat this the same way. Some will accept your rental history as evidence in place of genuine savings. Others may accept gifts or inheritance under certain conditions.

We’ll match you with a lender whose policies suit your situation — whether you’re a disciplined saver or you’ve received financial help along the way.

If saving a full deposit is a stretch, a family guarantee (also called a guarantor loan) can be a game-changer.

Instead of handing over money, a parent or family member can offer equity from their property as security for your loan. This can help you:

It’s important that guarantors understand the risks and legal responsibilities — and we’ll guide both you and your family through the process with transparency and care.

We’re not just here to get you a loan — we’re here to get you home.

Whether you’re just starting to save or already house-hunting, we’re here to help you make informed, confident decisions. Buying your first home doesn’t have to be overwhelming — not when you’ve got the right team on your side.

Talk to us today and let’s map out your path to home ownership. Contact us